[ad_1]

Donald Trump last week told a court he could not secure a $454 million bond, but today he is now reportedly “more than $5 billion richer,” and saw his net worth “more than double” in the space of just hours, all thanks to the parent company of his Truth Social social media platform that went public Monday and began trading Tuesday morning.

(These numbers are fluid and not reflective of the stock’s closing number on Tuesday.)

“Former President Donald J. Trump’s social media company soared in its first day of trading on the Nasdaq on Tuesday,” The New York Times reported, just before market close, “giving the company an estimated market value of more than $8 billion, larger than established corporations like Mattel, Alaska Airlines and Western Union.”

“The biggest beneficiary of the market action has been Mr. Trump, who owns about 60 percent of Trump Media, making him the largest shareholder. His stake in the company — the parent of Truth Social, the online platform that is Mr. Trump’s main megaphone for reaching supporters and attacking critics — is worth about $5 billion on paper.”

Some are calling for an investigation by the Securities and Exchange Commission (SEC), and labeling the arrangement “absurd” and “dangerous.”

Truth Social is now owned by Trump Media, formerly a shell company named Digital World Acquisition Corp. On Monday the stock closed at $49.95. On Tuesday under its new DJT symbol shares skyrocketed, at times up nearly 60%, before closing up just 16%, at $57.99, according to Google.

Shares “have spiked about 300% so far this year,” CNN reported. “That includes a 35% surge Monday after the deal closed. Shares popped again at the start of trading Tuesday — investors’ first opportunity to trade the stock after the merger, under the new DJT ticker.”

“The skyrocketing share price comes despite the fact that Trump Media is burning through cash; piling up losses; and its main product, Truth Social, is losing users.”

READ MORE: Gag Order: Trump Criminal Case Judge Lays Down the Law

“Trump Media generated just $3.4 million of revenue through the first nine months of last year, according to filings. The company lost $49 million over that span,” CNN adds. “And yet the market is valuing Trump Media at approximately $13 billion.”

What does that mean?

“For context, Reddit was only valued at $6.4 billion at its IPO last week — even though it generated 160 times more revenue than Trump Media. (Reddit hauled in $804 million in revenue in 2023, compared with Trump Media’s annualized revenue of about $5 million.)”

Just before noon, Forbes reported, “Donald Trump is more than $5 billion richer today after shares of Trump Media & Technology Group, which operates the Truth Social platform, began trading on the Nasdaq. Forbes now estimates that Trump—who was worth an estimated $2.3 billion before shareholders voted last week to approve the long-delayed plan to take TMTG public—now has a net worth of $7.3 billion, as of 11:30 a.m. Eastern. That makes the former president one of the 400 richest people in the world, according to Forbes’ real-time tracker.”

Professor of Public Policy at UC Berkeley, former Secretary of Labor Robert Reich, is calling this “absurd.”

“We’ve reached an absurd & dangerous point where most of Trump’s net worth will tied up in a publicly traded media company, ‘DJT.’ What foreign countries and funds will take shares in DJT, and what kind of leverage will that grant them? The media must report more on this threat!”

Reich dug deeper.

“Follow the money, folks. The biggest institutional investor in the Truth Social SPAC is Susquehanna Int’l Group. It was co-founded by GOP billionaire Jeffrey Yass, who is also a major investor in the parent of TikTok. Trump recently did a 180 on banning TikTok. Wonder why?”

READ MORE: Trump Says He Thinks He’s ‘Allowed’ to Accept Foreign Money to Pay Fines

U.S. Senator Brian Schatz (D-HI) is calling for an “explanation.”

“If it is true that Donald Trump’s net worth just increased by more than a billion dollars the public deserves to know why. This is likely the biggest financial windfall for a politician in world history, so it requires a detailed and transparent explanation.”

Former FBI General Counsel Andrew Weissmann, a professor of law and a frequent MSNBC legal commentator served up a short response, invoking the U.S. Securities and Exchange Commission.

Three letters: S.E.C. https://t.co/W1uo3Cj9W2

— Andrew Weissmann (weissmann11 on Threads)🌻 (@AWeissmann_) March 26, 2024

Attorney Robert J. DeNault posted a warning: “I know it’s little solace to anyone, but whatever scheme is going on to inflate the value of Truth Social to $71 a share right now is subject to a lot of fraud and securities laws that Trump’s other businesses largely escape oversight on. This is a public company.”

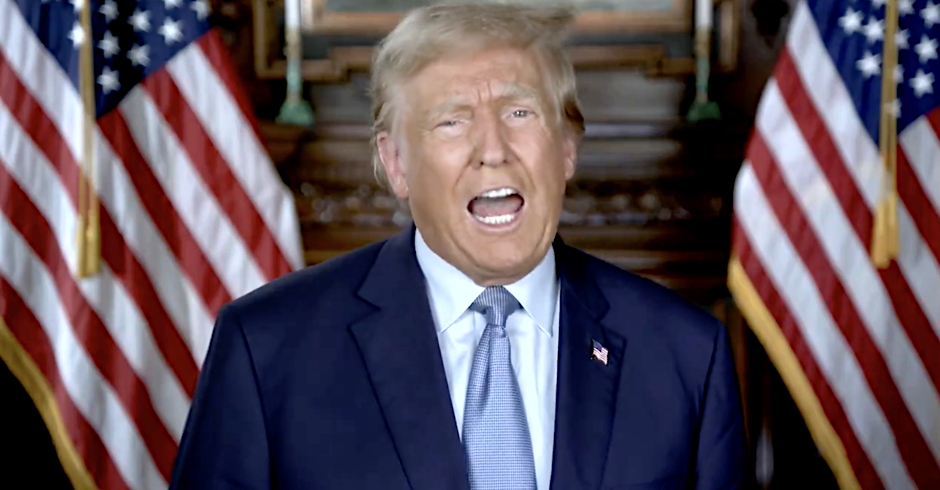

Image via Shutterstock

[ad_2]