[ad_1]

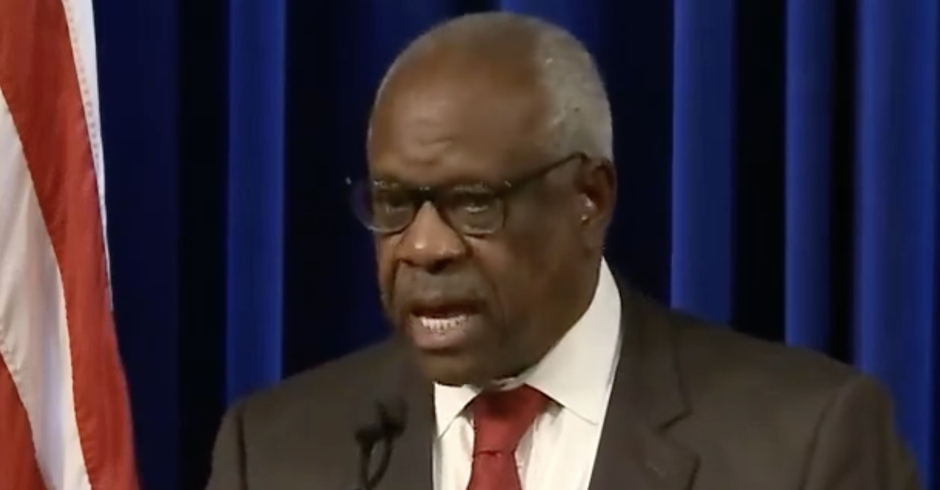

Billionaire businessman and conservative megadonor Harlan Crow, who for more than two decades has funded almost annual luxury, all-expenses-paid vacations, travel, lodging, food, and even clothing for Supreme Court Justice Clarence Thomas and at times, his far-right extremist and activist wife Ginni Thomas, purchased his mother’s house and paid the tuition of their ward and grandnephew, just refused to provide the U.S. Senate Finance Committee with some very basic information it requested last week.

Pointing to bombshell investigations from ProPublica, Senate Finance Committee Chairman Ron Wyden requested a full accounting of all the gifts Crow has lavished on Clarence and Ginni Thomas over the past two-plus decades.

“With every new revelation in this case, it becomes clearer that Harlan Crow has been subsidizing an extravagant lifestyle that Justice Thomas and his family could not otherwise afford,” Wyden said in a statement on the Committee’s official Senate website. “This is a foul breach of ethics standards, which are already far too low when it comes to the Supreme Court. I gave Mr. Crow until May 8th to provide a full account of the gifts he provided to Justice Thomas’s family. Should he fail to comply, I will explore using other tools at the committee’s disposal to obtain this critical information.”

Through his attorney, Harlan Crow has just refused, as CNN reports.

Gibson Dunn attorney Michael Bopp claims in a letter the Finance Committee lacks a legislative purpose to request the information, and “lacks jurisdiction” and “authority” to “conduct tax audits or judicial ethics inquiries.” He also claims a violation of the separation of powers.

(Some legal experts disagree with Bopp.)

“We of course respect the authority of the Senate Finance Committee to consider and report tax-related legislation. But that is evidently not the goal of this attempt to tarnish the reputation of a sitting Supreme Court Justice and his friend of many years, Mr. Crow,” Bopp writes. “Indeed, the Chairman’s latest statement about this inquiry, made on May 4, 2023, and available on the Committee website, speaks of ethics standards (which are not the province of the Senate Finance Committee) and makes no mention of gift tax laws.”

“The Letter also suggests that certain real estate transactions may raise gift tax issues,” Bopp adds. “Mr. Crow’s purchase of property in Savannah, Georgia (through his LLC) complied with federal and state gift tax laws.”

He offers what he suggests are the terms of the deal in which Crow bought Clarence Thomas’ mother’s house, where she continues to live rent free.

“Contrary to news reporting, as part of the overall transaction to purchase Justice Thomas’s mother’s home and two lots, Mr. Crow’s LLC provided a lifetime occupancy agreement for his mother, Mrs. Leola Williams, who was 84 years old at the time of the sale,” Bopp writes. He says the sale would not have gone through without the “lifetime occupancy agreement.”

Eric Seagall, a Georgia State University law professor and author of a book on the Supreme Court, offered this observation Tuesday: “Crow’s law firm Gibson, Dunn who successfully argued Bush v Gore while [Ginni Thomas] was getting jobs for Heritage [Foundation] folks in the not yet elected Bush Administration and where Scalia’s son works. The world is small (disclaimer I once worked for Gibson Dunn).”

On Monday, Senate Judiciary Chairman Dick Durbin also requested a similar list from Harlan Crow, including “all gifts, payments, and items of value exceeding $415 given by you, or by entities you own or control,” and “all real estate transactions in which you, or any entity you own or control…conducted with a Justice of the Supreme Court or a member of the Justice’s family.”

No word yet on a response to that letter.

The post Clarence Thomas’ Billionaire Benefactor to Democratic Senators Asking for Receipts: No appeared first on The New Civil Rights Movement.

[ad_2]