[ad_1]

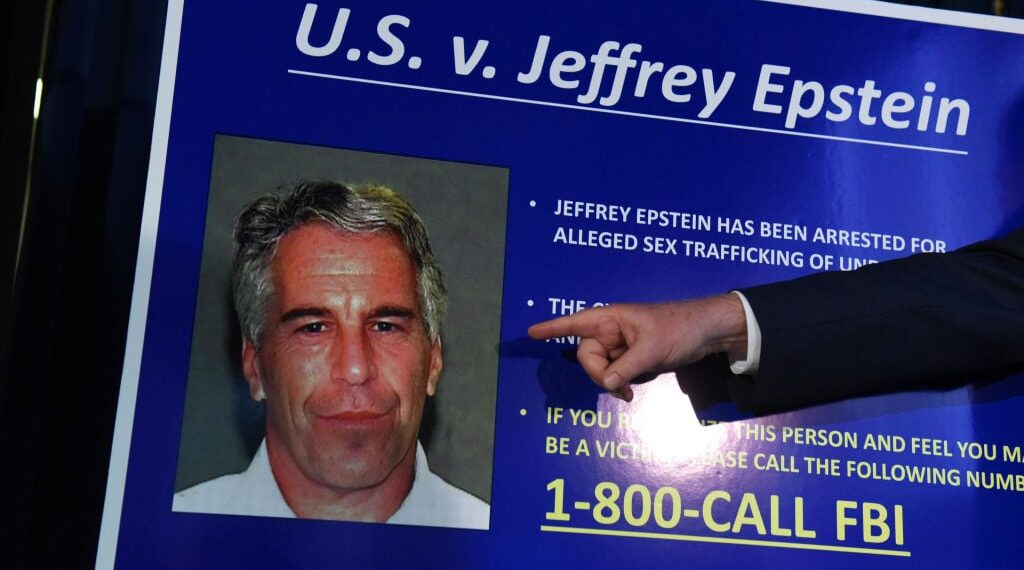

When Deutsche Bank took convicted sex offender Jeffrey Epstein on as a client a decade ago, it expected to reap as much as $4 million in annual fees from the hundred-million plus in money flows through his accounts. What appeared worthwhile reputational risk at the time has proven anything but: Six years after adding him to their client roster, the other DB had to cut ties with him on account of his being arrested and charged with pedophilia (again). Since then, it’s paid many multiples of whatever it earned on those flows: $150 million to New York State, $26 million to its shareholders. But not a penny to those on whom a significant chunk of those flows were used: Epstein’s many victims.

Well, they’d like to change that.

A… woman suing Deutsche Bank was sexually abused by Epstein and trafficked to his friends from about 2003 until about 2018 and was also paid in cash for sex acts, according to her suit. The bank ignored red flags including payments to numerous young women and large withdrawals of cash, the suit says. New York’s regulator found Epstein, his related entities and associates had more than 40 accounts at Deutsche Bank…. “Knowing that they would earn millions of dollars from facilitating Epstein’s sex trafficking, and from its relationship with Epstein, Deutsche Bank chose profit over following the law,” the suit states.

Nor does Epstein’s pre-DB bank get off scot-free.

The unnamed woman suing JPMorgan is a former ballet dancer in New York who was recruited by another young female and sexually abused by Epstein from 2006 through 2013, according to her suit. She alleges she was also trafficked to his friends. Large sums of money were withdrawn from JPMorgan to make cash payments to her and other women, the suit says. The suit alleges that Epstein used the cash to pay for sex acts…. The suit says JPMorgan turned a blind eye to Epstein’s activities in exchange for financial gain. Epstein introduced [then-private banking head Jes] Staley to wealthy clients and helped the bank arrange its deal to buy a majority stake in Highbridge Capital in 2004, at the peak of Epstein’s alleged sex trafficking, according to the suit….

The two lawsuits seek class-action status and unspecified financial damages.

Jeffrey Epstein Accusers Sue Deutsche Bank, JPMorgan [WSJ]

For more of the latest in litigation, regulation, deals and financial services trends, sign up for Finance Docket, a partnership between Breaking Media publications Above the Law and Dealbreaker.

[ad_2]